More Coverage

Twitter Coverage

Satyaagrah

Written on

Satyaagrah

Written on

Satyaagrah

Written on

Satyaagrah

Written on

Satyaagrah

Written on

JOIN SATYAAGRAH SOCIAL MEDIA

"In every empire's fall, a lesson is whispered": The enigmatic tale of Subrata Roy and the Sahara Empire, from ambitious business ventures to the infamous Rs 24,000 crore scam and the decisive steps towards redressal and justice for millions of investors

Subrata Roy, the founder of the Sahara Group, a towering figure in the Indian business landscape, passed away at the age of 75 on Tuesday, November 14, 2023. His demise marks the end of an era for the Sahara Group, a conglomerate with interests spanning finance, real estate, media, and sports. Roy's journey from modest beginnings to the pinnacle of corporate India is a story of ambition, controversy, and resilience.

|

Born in 1948, Roy's early life was marked by humble beginnings. His rise to prominence began with the establishment of the Sahara Group in 1978, which quickly grew into a massive empire, making him one of the most influential figures in Indian business. However, Roy's career was not without its share of controversies. He faced allegations of fund mismanagement amounting to a staggering Rs 24,000 crore, a case that captured the nation's attention and highlighted the complexities of corporate governance in India.

Despite these challenges, Roy remained a respected figure in the business community. His entrepreneurial spirit and ability to navigate through various business sectors won him admiration, even among his critics. His approach to business was often characterized by a blend of traditional values and modern practices, a combination that helped Sahara Group thrive in a rapidly changing economic landscape.

|

Roy's death was confirmed following a cardiac arrest at Kokilaben Dhirubhai Ambani Hospital & Medical Research Institute (KDAH) in Mumbai, where he was admitted after a decline in health. The news of his passing sent ripples through the Indian business world, with many remembering him not just for his business acumen but also for his philanthropic efforts. Sahara Group, under Roy's leadership, was involved in various social and charitable initiatives, reflecting his belief in giving back to society.

Survived by his wife Swapna Roy and two sons, Sushanto and Seemanto Roy, who reside abroad, Subrata Roy's legacy is a complex tapestry of success, controversy, and philanthropy. His journey from a small-town entrepreneur to the head of one of India's largest conglomerates is a testament to the dynamic nature of the Indian business landscape. As the Sahara Group mourns its founder, the business community reflects on the lessons from his life – a blend of ambition, resilience, and the enduring importance of ethical business practices.

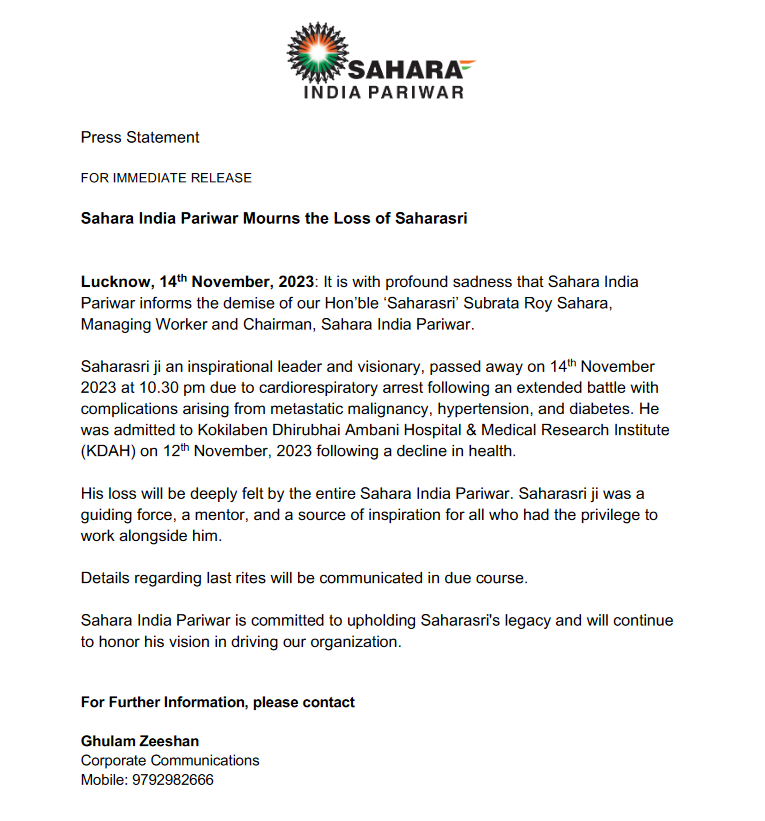

In an official statement, the Sahara Group paid tribute to its late founder, Subrata Roy, describing him as "Saharasri ji an inspirational leader and visionary, passed away on 14th November 2023 at 10.30 pm due to cardiorespiratory arrest following an extended battle with complications arising from metastatic malignancy, hypertension, and diabetes." This statement not only highlights the health struggles Roy faced in his final days but also encapsulates the immense respect and admiration he garnered throughout his life.

|

Subrata Roy's journey from a modest background in Araria, Bihar, to becoming the head of one of India's most sprawling conglomerates is nothing short of remarkable. Born in 1948, he founded Sahara India Pariwar in 1978 with an initial capital of just Rs 2000. What followed was a story of extraordinary growth and expansion. Under Roy's leadership, Sahara India Pariwar diversified into a range of sectors, including finance, real estate, media, and sports, becoming a household name across the country.

One of the most astounding aspects of Roy's legacy is the sheer scale of employment generated by his conglomerate. Sahara India Pariwar became the second-largest employer in India after the Indian Railways, boasting a workforce of around 1.2 million people. This feat is a testament to Roy's vision and his commitment to creating job opportunities on a massive scale.

Furthermore, Sahara India Pariwar claimed to have more than 9 crore investors, representing about 13% of all households in India. This staggering figure illustrates the deep penetration of the Sahara Group into the Indian market and the trust Roy managed to build among millions of Indians. His ability to connect with the common man and provide them with investment opportunities was one of the cornerstones of his business philosophy.

|

Roy's entrepreneurial journey is a classic tale of rags to riches, underscored by his ability to spot opportunities in diverse sectors and his relentless pursuit of growth. His story is not just about the accumulation of wealth and expansion of business, but also about the creation of an empire that touched the lives of millions, both directly and indirectly. As the Sahara Group mourns the loss of its founder, Subrata Roy's legacy remains a source of inspiration and a benchmark for entrepreneurial success in India.

Subrata Roy's Sahara Group rose to national and international prominence through a series of ambitious projects and acquisitions that showcased his bold vision and business acumen. Key among these were the development of Aamby Valley City, a luxurious township in India, and the acquisition of iconic hotels like the Plaza in New York City and the Grosvenor House Hotel in London. These ventures not only expanded the Sahara Group's global footprint but also reinforced its status as a major player in the real estate and hospitality sectors.

The group's foray into the media sector was equally impactful, with ventures like Sahara TV—later rebranded as Sahara One—and the Hindi-language newspaper Rashtriya Sahara. These media entities gained considerable success and influence, further diversifying the group's business interests and consolidating its presence in the Indian market.

|

Subrata Roy's persona as India's most flamboyant and enigmatic tycoon added to the allure of the Sahara brand. Known for his fleet of private jets and helicopters, and a mansion modeled on the White House, Roy's lifestyle was as grand as his business ventures. His larger-than-life image and colourful lifestyle, combined with considerable political connections, kept him constantly in the public eye, making him a subject of fascination and intrigue.

However, Roy's journey was not without its challenges. In 2011, the Sahara chief found himself embroiled in a major financial scandal, marking a significant turning point in his career. The Sahara Scam, as it came to be known, involved allegations of duping investors of a colossal sum of Rs 24,000 crore. This controversy not only brought intense scrutiny to the Sahara Group but also raised critical questions about corporate governance and investor protection in India.

This scandal was a stark contrast to Roy's earlier achievements and cast a shadow over his legacy. It highlighted the complexities and risks inherent in managing vast business empires and the fine line between ambition and overreach. As the business world reflects on Roy's life and career, the Sahara Scam serves as a reminder of the importance of ethical business practices and transparent financial dealings. Despite the challenges and controversies, Subrata Roy's impact on the Indian business landscape remains undeniable, marked by a blend of audacious ventures, a flamboyant lifestyle, and a commitment to pushing the boundaries of what is possible in the world of business.

|

2011 Sahara Chit Fund Scam

The 2011 Sahara Chit Fund Scam stands as one of the most significant financial frauds in Indian history, involving massive sums of money, regulatory breaches, and a high-stakes legal battle. This scandal was brought to the forefront in 2011 when a chartered accountant named Roshan Lal exposed discrepancies in housing bonds issued by two Sahara companies, Sahara India Real Estate Corporation (SIREC) and Sahara Housing Investment Corporation (SHIC). The crux of the issue lay in how these entities raised substantial funds without adhering to proper accountability measures.

The magnitude of the scam, estimated at a staggering Rs 24,000 crore, shook the foundations of the Indian financial sector. The Securities and Exchange Board of India (SEBI), the regulatory authority overseeing securities and commodity market activities in India, played a crucial role in uncovering the irregularities. SEBI's investigation revealed that Sahara was raising funds through Optionally Fully Convertible Debentures (OFCDs) without obtaining the necessary approvals, a clear violation of financial regulations.

|

| Sahara Group Managing Worker and Chairman Subrata Roy passes away due to cardiorespiratory arrest: Sahara Group |

In response to these findings, SEBI issued a directive in 2011 requiring the two implicated Sahara companies to refund the money raised from investors. This decision marked a turning point in the scandal, bringing to light the complexities of India's financial landscape and the challenges in ensuring corporate compliance. The involvement of such a large amount of money and the high-profile nature of the Sahara Group amplified the impact of the scandal, attracting widespread attention and raising serious questions about regulatory oversight and investor protection.

The Sahara Scam not only highlighted the need for more stringent regulatory mechanisms but also underscored the importance of corporate transparency and ethical business practices. It served as a wake-up call for the entire industry, prompting a reevaluation of the systems and processes governing corporate fundraising activities in India. As the case unfolded, it became a symbol of the fight against corporate malfeasance, emphasizing the critical role of regulatory bodies like SEBI in safeguarding the interests of investors and maintaining the integrity of the financial markets.

|

This scandal, set against the backdrop of Subrata Roy's otherwise illustrious career, serves as a stark reminder of the thin line that exists between ambition and regulatory adherence in the high-stakes world of business. As the story of the Sahara Scam continues to be a point of reference in discussions about corporate governance in India, it stands as a testament to the complexities and challenges inherent in managing vast business empires and the paramount importance of operating within the legal and ethical boundaries of the business world.

The legal fallout of the Sahara Scam reached its peak with Subrata Roy's arrest in March 2014. This marked a significant moment in the saga, as Roy, a towering figure in the Indian business world, found himself behind bars in Tihar Jail, one of the most notorious prisons in India. His imprisonment, followed by his release on parole in 2017, was a dramatic turn in a story that had captured the nation's attention for years. This period in jail, a stark contrast to his previous lavish lifestyle and influential status, significantly tarnished both his and the Sahara Group's reputation, casting a long shadow over the legacy of one of India's most prominent business figures.

|

In a recent development, signaling a significant step towards resolution and justice for the affected investors, Union Home Minister and Minister of Cooperation, Amit Shah, inaugurated the Central Registrar of Cooperative Societies (CRCS)-Sahara Refund Portal in New Delhi on July 18, 2023. This portal, developed by a subsidiary of IFCI Ltd., is a critical initiative aimed at assisting the more than 10 crore depositors of the Sahara Group in claiming their refunds in a manner that is both timely and transparent.

The launch of this refund portal represents a crucial effort by the Indian government to rectify the wrongs done to millions of investors who had put their trust in the Sahara Group. It is a reflection of the government's commitment to protecting the interests of small investors and upholding the principles of transparency and accountability in the financial sector. The creation of such a platform is not just about providing financial redress but also about restoring faith in the system that oversees corporate conduct in India.

This move is also indicative of the evolving landscape of corporate governance and investor protection in India. The establishment of the CRCS-Sahara Refund Portal is a testament to the growing recognition of the need for robust mechanisms to safeguard investors' interests, especially in the wake of large-scale financial scandals like the Sahara Scam. It highlights the government's proactive approach in addressing the challenges posed by such cases and reinforces the message that regulatory compliance and ethical business practices are non-negotiable standards in the corporate world.

|

As the story of the Sahara Scam and Subrata Roy draws to a close with these recent developments, it leaves behind a legacy of lessons on the importance of ethical leadership, corporate responsibility, and the need for a vigilant and responsive regulatory framework. The establishment of the refund portal marks a significant step towards closure for the millions of investors affected by the scam, and a hopeful sign of a more accountable and transparent future in India's corporate governance.

Support Us

Support Us

Satyagraha was born from the heart of our land, with an undying aim to unveil the true essence of Bharat. It seeks to illuminate the hidden tales of our valiant freedom fighters and the rich chronicles that haven't yet sung their complete melody in the mainstream.

While platforms like NDTV and 'The Wire' effortlessly garner funds under the banner of safeguarding democracy, we at Satyagraha walk a different path. Our strength and resonance come from you. In this journey to weave a stronger Bharat, every little contribution amplifies our voice. Let's come together, contribute as you can, and champion the true spirit of our nation.

|  |  |

| ICICI Bank of Satyaagrah | Razorpay Bank of Satyaagrah | PayPal Bank of Satyaagrah - For International Payments |

If all above doesn't work, then try the LINK below:

Please share the article on other platforms

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text. The website also frequently uses non-commercial images for representational purposes only in line with the article. We are not responsible for the authenticity of such images. If some images have a copyright issue, we request the person/entity to contact us at satyaagrahindia@gmail.com and we will take the necessary actions to resolve the issue.

Related Articles

- From juice stalls to orchestrating a billion-rupee scam, Saurabh Chandrakar & Ravi Uppal now revel in infamy, Stars like Tiger Shroff & Sunny Leone highlighted their lavish UAE wedding, exposing a grim nexus of fame and dark money in the Mahadev App saga

- "Rather fail with honor than succeed by fraud": ED hits Byju's with a staggering Rs. 9,000 crore notice for FEMA violations, as CEO Raveendran avoids summons, deepening the crisis in the edtech behemoth amid financial and compliance turmoil

- "Liquor Scam": CBI dives deep into Delhi's excise policy scandal involving ED's Asst Director Pawan Khatri, liquor magnate Aman Dhall and others, a tale of bribes, covert meetings & policy shakeup, revealing the dark underbelly of Delhi's power corridors

- "A scandal that stains leadership": In a stunning dawn operation, ex-CM Chandrababu Naidu arrested for his alleged role in a ₹3,300 crore AP State Skill Development Corporation scam, marking a shocking turn in Indian politics & igniting nationwide debates

- Unveiling the NEET UG 2024 scandal, CBI targets the notorious Sanjeev Mukhiya gang with CBSE city coordinator Ehsanul Haq and chairman Shabir Ahmed under scrutiny, exposing corruption across Bihar & Jharkhand, involving tampered exam papers and fraud

- Thoothukudi people want reopening of Sterlite Copper plant they got shut in 2018, say they were cheated in the name of protests

- "Indifference and neglect often do much more damage than outright dislike": BharatPe seeks Rs 88 crore in damages from Ashneer Grover and family; requested court to restrain Grover from continuing his 'vitriolic campaign' against company on social media

- Natwar Singh, an ex-foreign minister, and the Congress Party through a series of illegal oil transactions under Saddam Hussein’s regime’s oil-for-food program were involved in the Iraqi oil scam: Detail in the Volcker Committee Report

- "Reality really is theater. It's all so nonsensical, ridiculous and chaotic": Year 2022 was a chaotic one, from Twitter's ownership passed on to Elon Musk with wide layoffs to FTX, once trusted crypto company, imploded under Sam Bankman-Fried's leadership

- "From dreams of upliftment to tales of deceit": India's colossal minority scholarship scam revealed: 53% of its beneficiaries unmasked as frauds, as aspirations turn to dust, the depth of the conspiracy stuns a nation, Smriti Irani initiates a CBI inquiry

- NMA received outrage from Netizens for asking ASI to remove Ganesh idols from Qutub Minar complex to National Museum as it will remove the big evidence of Islamist vandalism: Ganesha is the prime god of Hinduism

- Same Congress which is offering freebies in the states during polls has not paid rent for Lutyens Delhi bungalows for almost a decade, Rent worth crores pending: RTI revelation

- "लड़की हूँ, जबरन लड़ूंगी": Ayushi Patel, scoring just 365 in NEET, tried to outsmart the system with forged claims of a 'torn' OMR sheet, endorsed unwittingly by Priyanka Gandhi; Allahabad High Court wasn't fooled, green-lighting NTA's legal retaliation

- Hyundai celebrating ‘Kashmir Solidarity Day’ had been facing nationwide boycott calls in India: Issues second statement that post by Pakistani counterpart unauthorised, expresses ‘regret’ for pro-terrorist stand

- "एक चेहरे पर कई चेहरे": 'Nationalist' Aquib Mir, posing as 'Ravi Rajput,' tricked Anna Jain, forced her into a nikah, looted her of 50 lakhs, and beat her daily to wear a hijab; publicly claims secular while privately enforcing strict Islamic practices