More Coverage

Twitter Coverage

Satyaagrah

Written on

Satyaagrah

Written on

Satyaagrah

Written on

Satyaagrah

Written on

Satyaagrah

Written on

JOIN SATYAAGRAH SOCIAL MEDIA

"झूठे सपनों का सौदागर": From a $22 billion edtech unicorn to bankruptcy, Byju's meteoric rise and dramatic fall is riddled with fraud, trapping parents in deceptive loan trap, selling false dreams of academic success & facing legal battle over unpaid dues

On 17th September, all eyes will be on the Supreme Court of India as it prepares to hear a crucial appeal filed by US-based creditor Glas Trust Company LLC. This appeal challenges the decision made by the National Company Law Appellate Tribunal (NCLAT), which had previously halted insolvency proceedings against the once-mighty ed-tech firm, Byju’s. In addition to this, the NCLAT had also given the green light to a Rs 158.9 crore settlement between Byju’s and the Board of Control for Cricket in India (BCCI), a move that had added complexity to the already precarious situation faced by the company. Once valued at USD 22 billion, Byju’s, which was once the pride of India’s booming tech sector, is now fighting to stay afloat financially.

|

In a recent hearing, the case drew the attention of a three-judge bench led by Chief Justice DY Chandrachud, with Justice JB Pardiwala and Justice Manoj Misra joining him. The urgency of the situation was highlighted when senior advocate NK Kaul, representing Byju’s, and Solicitor General Tushar Mehta, representing the BCCI, both requested an expedited hearing. Given the significant developments in the case, Kaul suggested that another plea related to the same matter, already scheduled for 17th September, be heard on the same day. The Supreme Court agreed to hear Byju’s insolvency case on 17th September, setting the stage for a critical day in the company’s ongoing legal and financial struggles.

Chief Justice Chandrachud accepted the suggestion without hesitation. This appeal, filed by Glas Trust Company LLC, stems from an earlier decision by the NCLAT. In that ruling, the NCLAT had set aside the insolvency proceedings initiated by the Bengaluru bench of the National Company Law Tribunal (NCLT) and approved the Rs 158.9 crore settlement between Byju’s and BCCI. The crux of the matter revolves around a payment default linked to a sponsorship agreement between the ed-tech giant and India’s cricket board, which has now escalated into a legal battle involving multiple parties.

However, the Supreme Court intervened and took a firm stance. Describing the NCLAT’s decision as unconscionable, the Supreme Court placed a stay on the tribunal’s ruling and ordered the BCCI to hold the settlement amount in a separate escrow account until further notice. This decision ensures that the money remains untouched while the legal proceedings unfold, keeping the door open for a potential reversal or modification of the previous rulings.

This case, which once would have been unimaginable for a company like Byju’s, highlights the stark contrast between its meteoric rise to the top of the ed-tech world and the steep fall that now threatens its very existence. As the legal battle continues, the outcome of the upcoming Supreme Court hearing on 17th September will be pivotal, not only for Byju’s but for the broader ed-tech industry in India, which has been watching closely as the drama unfolds.

|

Another layer of complications amid court ruling in the US

As Byju's prepares for the upcoming court hearing in India on Tuesday, the company’s financial situation has taken a new turn with recent developments in the United States. On 10th September, a Delaware court ruled to place several of Byju’s key subsidiaries, including Neuron Fuel Inc., Epic! Creations Inc., and Tangible Play Inc., into involuntary Chapter 11 bankruptcy. This decision came after these units failed to provide crucial financial information requested by their creditors, adding further complications to Byju’s already fragile financial standing. According to Byju’s Interim Resolution Professional, Pankaj Srivastava, the Delaware court’s decision was "surprising" and "in conflict" with the ongoing insolvency proceedings in India, sparking concerns about how these parallel legal battles will affect the company’s future. Srivastava has since sought to stay the effect of the US bankruptcy ruling, hoping to delay or mitigate its impact on Byju’s global operations.

The Delaware court ruling undoubtedly adds a layer of complexity to an already messy situation. This new challenge emerges as Byju’s struggles to stabilize its financial standing, which has been under scrutiny for some time. Back in June, US creditors led by HPS Investment Partners had accused Byju’s founder, Byju Raveendran, of violating debt contracts by allegedly withholding important financial details related to the company’s US units. These allegations led Judge Brendan Shannon to approve the creditors' request to appoint an independent Chapter 11 trustee to oversee and manage the affected units, a decision that further complicated the company's attempts to regain control over its financial crisis.

Byju’s now finds itself in the midst of parallel insolvency proceedings on two fronts—India and the US. This dual legal struggle is particularly troubling for the company, as it now has to deal with cases operating thousands of kilometres apart, each governed by a different legal framework. The conflict between these two sets of laws is bound to create further challenges, complicating efforts to resolve the financial and legal turmoil that has engulfed the ed-tech giant.

Despite the Delaware ruling, the units tied to Byju’s have firmly resisted the forced bankruptcy, arguing that the creditors lack the legal authority to initiate such proceedings. These units have gone so far as to accuse the creditors of using these bankruptcy filings as a "tactical manoeuvre" to gain leverage in other legal battles against Byju’s. Yet, despite these strong objections, the US court sided with the creditors, delivering a major blow to Byju’s efforts to protect its subsidiaries and maintain control over its finances.

This decision has only heightened the challenges faced by Byju’s, which is already grappling with a host of financial obligations and operational hurdles across its global business. As the company tries to fend off these legal actions in the US, the situation risks further destabilizing its global operations, making it increasingly difficult for the once-celebrated ed-tech unicorn to recover from its current predicament. The overlapping insolvency cases in the US and India have placed the company in a precarious legal position, raising serious questions about its future.

|

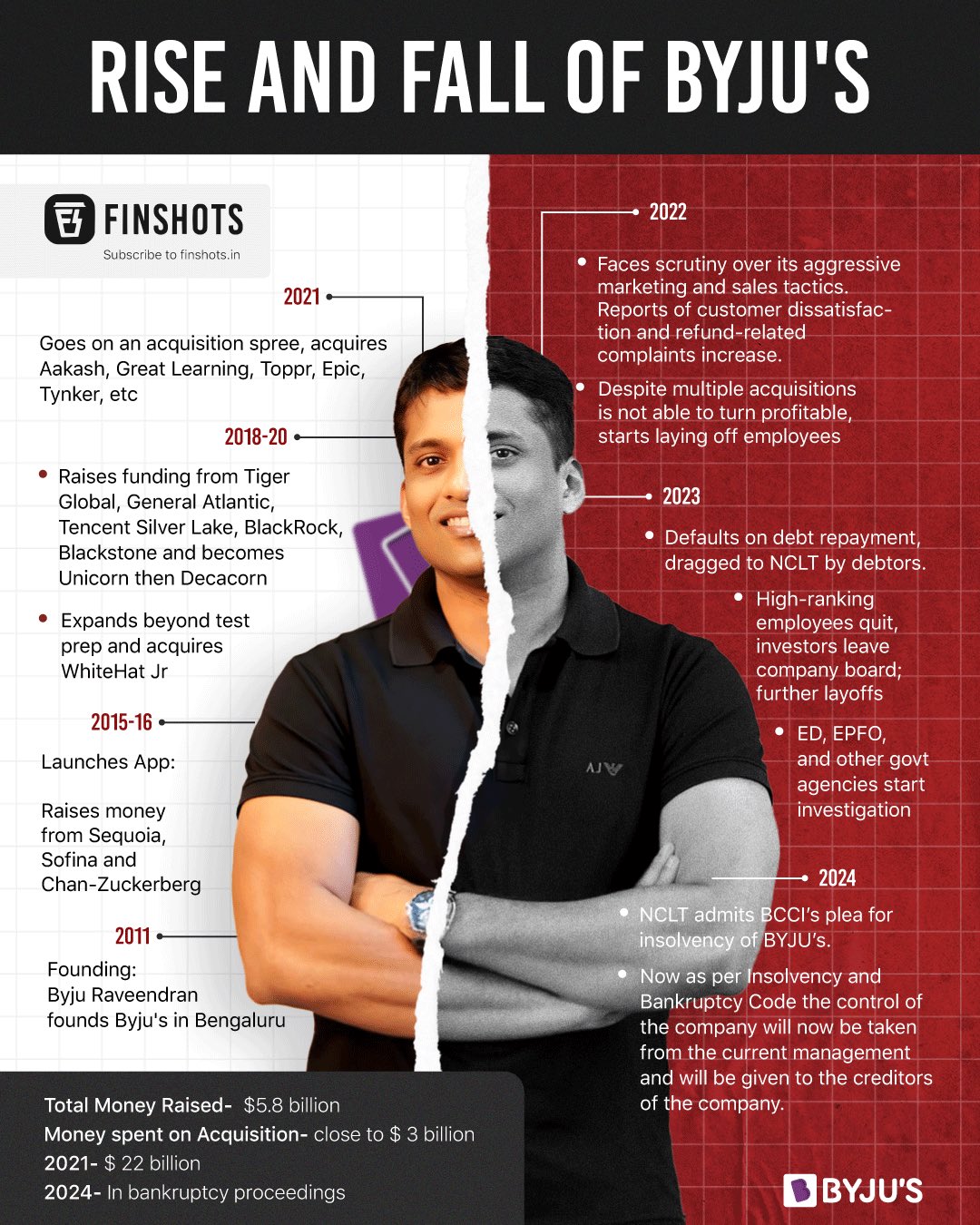

The rise and fall of Byju’s

In 2023, Byju Raveendran's net worth stood at an astounding Rs 17,454 crores, or USD 2.1 billion, ranking him among the world’s wealthiest individuals. Byju's was not just a household name in India; it had become a symbol of the future of education. Yet, by 2024, the Forbes Billionaire Index recorded a startling drop—Raveendran’s net worth had plummeted to zero. To truly grasp what led to such a dramatic downfall, it is important to explore how this company skyrocketed to fame, and more importantly, what caused its spectacular crash.

Founded in 2011, Byju’s quickly became a dominant force in the Indian education market, branding itself as the solution to the education sector’s inefficiencies. Byju Raveendran’s vision for a learning application, designed to cater to students from elementary school all the way to MBA level, disrupted the traditional methods of learning and helped catapult the company to incredible heights. In just over a decade, the company achieved a jaw-dropping valuation of $22 billion by 2022, making it India’s most valuable startup at the time.

Byju’s became the top seller in the online education sector, seemingly providing innovative solutions to modern-day learning challenges. The company took full advantage of the growing demand for accessible and technology-driven education. But, beneath the surface of success, Byju's rapid rise was built on shaky foundations. It solved a "problem" in the education system that, in reality, didn't exist. The flaws in its approach only became apparent when the COVID-19 pandemic struck.

The pandemic was a time of great uncertainty for families across the globe. In India, as the virus forced people to remain indoors, Byju’s saw a golden opportunity. With the entire education system moving online, Byju's doubled down on aggressive marketing strategies, broadcasting relentless advertisements that portrayed its learning programs as indispensable for students whose academic lives had come to a halt. But this relentless pursuit of growth at any cost came with its own set of moral dilemmas.

|

Byju's employed questionable tactics, setting unrealistic sales targets for its representatives, pressuring them to close deals regardless of the parents’ financial capacity. In many cases, it wasn't just about convincing parents of the value of the product—it was about trapping them in a financial loop that was difficult to escape. With the fear of their children's academic future hanging over them, many parents felt forced to subscribe to expensive educational packages. Desperation and a lack of alternative solutions left parents with little choice, creating a lucrative but highly questionable path for Byju's to boost its revenue.

The company's practices reached a new low in September 2021, when it was revealed that Byju’s sales representatives were engaging in unethical behavior to hit their sales targets. Parents were being pressured into taking loans from private firms, often without fully understanding the financial consequences. Many of these parents, struggling with job losses and reduced incomes during the pandemic, were left in financial ruin. The company preyed on parents’ anxieties about their children’s education, pushing them to make financial commitments they could not afford. Byju's aggressive tactics only deepened the growing sense of mistrust toward the company.

At a time when the majority of the workforce was without work, Byju's saw nothing wrong in continuing to apply pressure on struggling families. Instead of offering genuine solutions, it appeared the company was more focused on meeting its financial goals, without considering the long-term effects its practices would have on students, parents, and the broader community. The fraudulent manipulation of vulnerable families only added to the growing controversies surrounding Byju’s, eventually leading to its downfall.

Byju’s rise, built on the false promise of a better future for students, has now become a cautionary tale for all. The company’s downfall is not just a story of financial mismanagement—it’s a story of exploitation, where desperate parents and students were the real victims in the company's race for growth.

|

Sales executives trap vulnerable parents in guilt

Reports have uncovered the disturbing tactics employed by Byju’s sales representatives, commonly referred to as Business Development Executives (BDEs), who allegedly use guilt-trap techniques to coerce poor and illiterate parents into purchasing the company’s expensive educational packages. According to an article published in The Morning Context, titled “How Byju’s catches parents,” the author laid out in stark detail the manipulative strategies used by these representatives to target vulnerable families, pushing them into making financial commitments that they could neither afford nor fully understand.

Byju’s sales reps showed big dreams with unrealistic expectations to the parents to make sales. These representatives did not shy away from presenting parents with an overly optimistic and, at times, completely unrealistic vision of their children's academic success. Their goal was simple—convince parents that Byju’s learning programs were the only way to ensure their child’s future. Yet, the promises of brighter prospects were nothing more than a sales ploy designed to close the deal, with little regard for whether the program would actually benefit the child or the family’s financial situation.

Reports suggest that the sales executives often resorted to hard-sell tactics, approaching anyone and everyone they could find, desperate to meet their sky-high sales targets. The strategy was to get as many people as possible to register for the app, convincing them to stick with the program beyond the 15-day free trial period. It didn’t matter whether the families could actually afford the service—what mattered was getting the registration and locking them into the subscription. This approach highlights the extreme pressure placed on the company’s sales team to perform, often at the expense of ethical sales practices.

The sales team, often overworked and over-pushed, was forced to spend excessively long working hours in a bid to meet the unrealistic targets set by Byju’s management. This kind of environment fueled the use of aggressive and manipulative sales tactics, particularly targeting lower-middle-class and uneducated parents, who were less likely to have the resources or knowledge to understand the full extent of what they were committing to. These parents were often guilt-trapped into believing that not purchasing the program would condemn their children to a bleak academic future.

Many of these families, unable to afford the steep prices of Byju’s packages, were talked into taking out loans from private firms, leaving them in a precarious financial situation. The sales executives narrated grim stories of how a failure to sign up for Byju’s programs would result in their children falling behind, facing an uncertain future. It was a deeply unethical practice, preying on the anxieties of parents who only wanted the best for their children, and it left countless families trapped in debt and regret.

What makes this situation even more alarming is that Byju’s, once lauded as a pioneer in the ed-tech industry, is now facing intense criticism for its unethical practices. Instead of offering real, sustainable solutions to improve education, the company has become a symbol of corporate greed—willing to exploit vulnerable families to boost its own profits. The lower-middle-class parents and the uneducated were not just customers; they became victims of a system that cared more about numbers than about the well-being of those it was supposed to serve.

Byju’s used dreams of educational success as a lure, but in reality, it turned out to be nothing short of a trap—one that took advantage of parents’ deepest fears and hopes for their children’s futures. And as these families continue to struggle under the weight of loans they never should have been encouraged to take, it is clear that Byju’s has a long way to go in regaining the trust of the public it once sought to empower.

|

The loan trap

One of the most concerning issues with Byju’s is its loan options, which are offered through two partner companies. In many cases, Byju’s allegedly did not fully disclose to parents that the EMI (Equated Monthly Installment) option they were choosing was actually tied to a loan taken out in their name. This meant that parents unknowingly found themselves in debt, often unaware of the financial burden they had taken on. If a parent fails to pay the EMI, the loan company begins to issue threats, demanding repayment and warning of legal consequences. In some cases, this failure to meet payments even led to a negative impact on the CIBIL score of the parents, further jeopardizing their financial standing.

The situation becomes even worse when parents attempt to cancel their subscription. Byju’s has a strict policy where cancellation can only happen within the first 15 days. After this period, if a student stops using the app after a few months, the parents are still required to pay the remaining EMIs. This is because Byju’s has already secured its payment, leaving the liability of the loan entirely on the parents’ shoulders. The company has its money, and it is the parents who are left to deal with the burden of repaying a loan they may not have even fully understood.

Parents got stuck in loan traps, often without realizing the true nature of the financial agreement they had entered. In some cases, loans were initiated without clearly informing the parents about the details. This type of unethical behavior shows just how far Byju’s was willing to go in its relentless pursuit of profit, with little regard for the financial well-being of the families it claimed to be helping.

In India, where competition for resources is always fierce, families are constantly striving to give their children an edge. With a population of over 1.3 billion, the struggle to secure a better future often leads parents to invest their hard-earned money in private coaching and tuition. An entire industry thrives in India around private education, offering extra tutoring beyond regular school hours to prepare students for competitive entrance exams. This is where companies like Byju’s saw an opportunity to exploit the hopes and dreams of millions of parents.

As technology advanced and internet connectivity became widespread, the traditional private coaching industry evolved into the ed-tech sector. Byju’s was at the forefront of this transformation, luring millions of children and parents into what became a mad rush to get ahead. However, instead of being a beacon of innovation, Byju’s used its position to exploit the fears and aspirations of vulnerable families. Parents, desperate to ensure their children’s success, were unknowingly led into financial traps from which there was no easy escape.

The fact that parents were not only pressured into taking loans but were also left with no way out when their children no longer used the app highlights the predatory nature of Byju’s business model. This loan trap has ensnared countless families, leaving them struggling to repay debts they never should have been encouraged to take on in the first place. The lack of transparency and the aggressive sales tactics employed by Byju’s have turned what could have been a positive tool for education into a financial nightmare for many.

Byju’s has successfully tapped into the widespread anxiety of parents in India, where the competition to get into top schools and universities is intense. But instead of offering a genuine educational service, the company has taken advantage of this pressure, manipulating parents into believing that their children’s futures depend on signing up for expensive packages. In doing so, it has created a cycle of debt that continues to haunt many families long after their children have stopped using the platform.

The ed-tech revolution that Byju’s promised has, for many families, turned into a trap. What started as a solution for educational advancement has now left countless parents drowning in debt, all because of the predatory practices of a company that prioritized its profits over the very people it claimed to serve.

The exploitative company rose and fell too quickly

Despite the numerous exposés revealing Byju’s unethical practices, the exploitation by its sales representatives persisted. The company's aggressive growth strategy continued as it embarked on a spree of acquisitions, swallowing up smaller ed-tech companies. It remains unclear whether these acquisitions were part of a calculated move to eliminate competition or if Byju’s was seeking to adopt new techniques from these companies. What is certain, however, is that the company was intent on maintaining its dominance in the market at any cost.

While Byju’s was expanding, the company was also pouring vast sums of money into relentless advertising. However, as the pandemic restrictions eased and schools reopened, the demand for Byju’s online learning programs sharply declined. Parents, who once turned to Byju’s in desperation during the pandemic, began to pull their children out of the classes as regular schooling resumed. The company's business model, which thrived during the lockdowns, began to crumble once normalcy returned.

Byju’s financial troubles continued to mount. The company, which had confidently projected earnings of Rs 10,000 crores in 2021, was found to have failed in its basic obligations. As reported in 2024, Byju’s did not deposit TDS (Tax Deducted at Source) with the government, despite deducting it from the salaries of its employees. This act of negligence not only reflects poor financial management but also underscores a lack of responsibility toward its employees and the government.

In a shocking turn of events, the once-vaunted ed-tech giant saw 90% of its valuation wiped out in just 24 months. The reasons for this catastrophic decline are manifold—poor decision-making at the top, over-reliance on a pandemic-driven business model, and a failure to adapt to the sudden changes in the education sector. Byju’s, once hailed as a revolutionary force in education, had now become a cautionary tale of how unchecked greed and mismanagement can lead to a company's downfall.

|

BCCI dragged Byju’s to court over non-payment

Adding to Byju’s woes, in November 2023, the Board of Control for Cricket in India (BCCI) took the company to court over pending dues related to its sponsorship of the Indian cricket team. Byju’s had been a prominent sponsor of the Indian team since 2019, with its branding featured on the team’s jerseys. In June 2022, Byju’s extended its sponsorship agreement with the BCCI, but by November 2023, things had taken a turn for the worse.

Facing mounting financial troubles, Byju’s requested the BCCI to encash a Rs 140 crore bank guarantee, promising that the remaining Rs 160 crore would be paid in installments. However, Byju’s failure to follow through on its payment commitments prompted the BCCI to move the National Company Law Tribunal (NCLT) against the ed-tech giant.

BCCI dragged Byju’s to court, marking yet another significant blow to the company’s already tarnished reputation. The fallout from this legal dispute further deepened the cracks in Byju’s business model, exposing its inability to meet its financial obligations, even to a prestigious partner like the BCCI.

Reports from BCCI sources confirmed the ongoing legal action but noted that a resolution had yet to be reached. The situation highlighted the extent of Byju’s financial disarray, as it failed to honor agreements with one of India’s most prominent sports organizations. In addition to its partnership with the BCCI, Byju’s also had branding partnerships with major global organizations like the International Cricket Council (ICC) and FIFA. However, all of these agreements were up for renewal in 2024, and the company confirmed that it would not be renewing any of these partnerships.

This decision was likely driven by Byju’s deteriorating financial condition, as the company struggled to maintain its once-flourishing image in the face of legal challenges, financial mismanagement, and the collapse of its customer base.

Byju’s rise to the top of the ed-tech industry had been rapid, but its fall was even faster. What was once considered an educational juggernaut, promising innovation and progress, is now facing the consequences of its fraudulent practices, mismanagement, and failure to live up to its promises. The company’s inability to manage its financial responsibilities, along with its unethical treatment of parents and students, has left it in tatters, with its future looking increasingly bleak.

|

| What’s your opinion on the downfall of BYJU’S? |

NCPCR’s notice to Byju’s

In December 2022, the National Commission for Protection of Child Rights (NCPCR), India's apex child rights body, summoned Byju Raveendran, the CEO of Byju’s, over serious allegations that the company was engaging in malpractices to lure parents and children into buying its courses. This was a significant move, as the NCPCR took issue with Byju's alleged exploitation of parents and students through misleading sales tactics and loan-based agreements. The Commission’s concerns centered around the potential harm being done to children, as they believed that Byju’s practices went against the welfare of minors.

The NCPCR demanded that the CEO appear in person before the body, bringing with him detailed information regarding all of Byju’s courses, the structure of those courses, and the fees associated with them. The Commission also wanted a breakdown of the number of students enrolled in each course and a full explanation of the company's refund policy. In the order, the Commission was explicit in its concerns: “The Commission is in observance that indulging into malpractices to lure the parents/children into entering loan-based agreements and then causing exploitation is against the welfare of children…”. The NCPCR highlighted that such practices violate the CPCR Act, 2005, which is meant to safeguard the rights of children. Byju’s was required to provide documents proving its legal standing as a valid ed-tech company, alongside any other documents relevant to the concerns raised in the news reports.

This was a major turning point for Byju’s, as it brought into question the ethical foundation of the company’s business practices. The allegations of exploitation of parents and children only deepened the controversies surrounding Byju’s, which had already been facing criticism for its aggressive sales tactics.

Byju’s vacated all but one office

By March 2024, the situation for Byju’s had become so dire that the company decided to vacate all its offices, leaving only its Bengaluru headquarters operational, where 1,000 employees continued to work. The rest of its workforce was mandated to work from home. Even though the company shut down most of its physical offices, it continued to operate around 300 tuition centres for students in classes 6-10.

This decision came at a time when Byju’s was embroiled in legal disputes worth USD 1.2 billion with its creditors, coupled with a severe liquidity crisis. Byju’s, once a behemoth in the ed-tech space, was now struggling to stay afloat. Adding to its financial woes, the company had laid off thousands of employees over the years and had failed to pay full salaries for February 2024. Interestingly, the day before vacating its offices, the company made a partial payment of the pending salaries of 20,000 employees for the month of February. This last-minute disbursement seemed like a desperate move to salvage some semblance of goodwill among its workforce, but it did little to mask the deeper issues plaguing the company.

The decision to vacate all but one office underscored the severity of Byju’s downfall. What was once a booming ed-tech enterprise was now grappling with financial and legal crises, unable to meet even its most basic obligations, such as paying its employees on time. This move further highlighted the company's liquidity issues and inability to maintain its infrastructure while fighting a growing number of lawsuits.

|

Removal of Byju’s founder

In January 2024, the company’s major stakeholders made a significant decision—they voted to remove Byju Raveendran from his position as CEO, stripping him of his authority. This dramatic move occurred during an extraordinary general meeting, which Raveendran and his family members notably did not attend. His removal from leadership was a clear signal that Byju’s was trying to distance itself from the controversies surrounding its founder and the series of poor decisions that had led the company into crisis.

However, Byju Raveendran did not accept his ouster quietly. He contested the decision, claiming that the resolution to remove him was passed during a meeting attended by only a “small cohort of select shareholders”. In response, Byju’s issued a statement asserting that the resolutions passed during the extraordinary general meeting were “invalid and ineffective”. This statement indicated that the company was not fully aligned with its investors, and the internal conflict only added more turmoil to an already chaotic situation.

Raveendran’s downfall was precipitated by a series of crises that eroded investor confidence. He lost the support of major stakeholders following Deloitte’s resignation as Byju’s auditor due to concerns about corporate governance. Additionally, the company was embroiled in a legal dispute with lenders in the United States, which further damaged Raveendran’s credibility as a leader. His removal marked a significant shift in Byju’s management, but it was unlikely to resolve the deeper issues that had brought the company to the brink of collapse.

ED’s action against Byju’s

In February 2024, the Enforcement Directorate’s (ED) Bengaluru unit, which had been investigating potential violations of the Foreign Exchange Management Act (FEMA), took a decisive step in its case against Byju’s and its founder, Byju Raveendran. The ED concluded that there was a need for a Look-Out Circular (LOC) to be issued against Raveendran to prevent him from leaving the country. This decision came after the agency noted that Raveendran had spent the last three years frequently travelling between Delhi and Dubai. Sources familiar with the situation indicated that he had made a brief visit to Bengaluru earlier in the week. It was also reported that Raveendran was in Delhi the previous week for work, according to sources who provided this information to a news agency. However, when speaking to The Economic Times, Raveendran claimed he was currently in Dubai and mentioned that he had recently left for the emirate, stating that he was scheduled to travel to Singapore the following day.

One insider involved in the situation alleged that the decision to apply for an LOC with the Bureau of Immigration (BOI) was made in the best "interest of investors". The LOC, once issued, would prohibit Raveendran from leaving India if he returned, ensuring that he could not evade the ongoing investigation. According to a top government official, “The LOC, once opened, will ensure that the interest of investors is safeguarded and the case is taken to its logical conclusion without any difficulty.” This measure was deemed necessary to keep Raveendran within the jurisdiction of Indian authorities, allowing the ED to continue its probe into the company’s activities and ensure accountability for the company's actions.

The scrutiny on Byju’s parent company, Think & Learn Pvt Ltd, had been intensifying. In November 2023, the company was served with show-cause notices by the ED concerning alleged FEMA violations totaling Rs 9,362.35 crore. This staggering amount raised serious concerns about Byju’s foreign investment practices and how it had been managing its funds. The ED’s investigations were initiated in response to multiple complaints regarding Byju’s foreign investments and its overall business practices, which had come under increasing suspicion in recent years.

The fact that such large sums of money were under scrutiny speaks to the scale of the alleged violations. Byju’s rapid expansion, including its acquisition of multiple international ed-tech firms, had drawn attention from regulatory bodies, and the ED was now aiming to unravel the complex financial dealings that had allowed the company to grow so quickly. The show-cause notices issued by the ED highlighted the serious nature of the allegations, which questioned the legality of Byju’s foreign investments and its compliance with India’s foreign exchange regulations.

This latest development with the ED is yet another blow to Byju’s already tarnished reputation. As one of the most well-known and influential companies in India’s ed-tech sector, the allegations of fraud and malpractices are not only damaging to its business but also to the trust parents and students once had in the platform. The actions taken by the ED signal that the company’s financial dealings are under intense scrutiny, and it may only be a matter of time before the full extent of these violations comes to light.

Byju Raveendran’s attempts to distance himself from these accusations by travelling abroad have only fueled suspicion, making it clear that his movements are being closely monitored by authorities. The issuance of the LOC, which would effectively prevent him from leaving the country, is a strong indicator that the Indian government is serious about holding Byju’s accountable for its financial practices. The fallout from these investigations could have far-reaching implications for both Raveendran and the future of Byju’s as a company.

The ED had emphasized in its investigation, “The company was also stated to have made significant foreign remittances outside India and investments abroad which were allegedly in contravention of provisions of FEMA, 1999, and caused loss of revenue to the government of India.” These violations were not minor; they pointed to a large-scale manipulation of financial regulations that directly harmed the Indian economy. In an effort to uncover the full extent of these activities, the Enforcement Directorate (ED) conducted searches at Byju’s facilities as well as Raveendran’s house over the course of April 27 and 28 of last year. These raids resulted in the seizure of documents that detailed the company’s domestic and foreign investments, providing crucial evidence of the alleged violations.

The fact that such documents were seized is telling. It suggests that Byju’s, in its pursuit of rapid global expansion, may have disregarded key legal obligations, leading to a significant loss of revenue for the Indian government. The alleged violations of the Foreign Exchange Management Act (FEMA) reflect poorly on the company, further tarnishing its already battered reputation. This kind of misconduct not only impacts the company’s financial standing but also raises serious ethical concerns about its business operations.

As if the financial mismanagement and regulatory breaches were not enough, Byju’s also found itself at the center of a bizarre and symbolic incident that captured public attention. In a moment that reflected the growing frustration felt by many of Byju’s customers, a family made headlines when they took away a TV installed in one of Byju’s offices after the company refused to refund their money for a learning program. The video of the incident quickly spread across media platforms, showcasing the extent of anger and disillusionment that Byju’s had sparked among its customers.

According to media reports, the family had initially requested a refund for a tablet and a learning program they had purchased for their son, which they ultimately did not use. After weeks of trying to get their money back and being met with constant delays and excuses from Byju’s, the family’s patience ran out. In an act of sheer frustration, they entered Byju’s office, removed the TV that was installed there, and left the premises with it in tow. As they were leaving, the man in the video made it clear to the office staff that he would return the TV only when the refund was paid, demonstrating just how deeply the company’s customers felt betrayed by its refusal to honor basic refund requests.

This incident serves as a stark reminder of the extent to which Byju’s has alienated its customer base. What started as a promising ed-tech platform has now become synonymous with fraudulent practices and exploitation. The fact that a family felt they had no other option but to physically take something from Byju’s office speaks volumes about how the company’s mismanagement and lack of customer care have turned once-loyal users into embittered critics. This act was not just about the TV—it was about a company that had failed to deliver on its promises and had lost the trust of the very people it sought to serve.

Byju’s, which once stood at the forefront of India’s booming ed-tech industry, is now mired in controversy, from violations of financial regulations to defrauding parents and students. The company’s fall from grace has been swift and severe, and it has no one to blame but itself for the series of unethical decisions that have led to its current state. Whether it is foreign investment violations, misleading sales tactics, or the blatant refusal to provide refunds to disgruntled customers, Byju’s has consistently shown a disregard for the people and laws that allowed it to thrive in the first place.

Support Us

Support Us

Satyagraha was born from the heart of our land, with an undying aim to unveil the true essence of Bharat. It seeks to illuminate the hidden tales of our valiant freedom fighters and the rich chronicles that haven't yet sung their complete melody in the mainstream.

While platforms like NDTV and 'The Wire' effortlessly garner funds under the banner of safeguarding democracy, we at Satyagraha walk a different path. Our strength and resonance come from you. In this journey to weave a stronger Bharat, every little contribution amplifies our voice. Let's come together, contribute as you can, and champion the true spirit of our nation.

|  |  |

| ICICI Bank of Satyaagrah | Razorpay Bank of Satyaagrah | PayPal Bank of Satyaagrah - For International Payments |

If all above doesn't work, then try the LINK below:

Please share the article on other platforms

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text. The website also frequently uses non-commercial images for representational purposes only in line with the article. We are not responsible for the authenticity of such images. If some images have a copyright issue, we request the person/entity to contact us at satyaagrahindia@gmail.com and we will take the necessary actions to resolve the issue.

Related Articles

- Santi Ghosh and Suniti Choudhury: Two Teenage Freedom Fighters Assassinated British Magistrate

- NCPCR sought an explanation over 824 out of 1,027 Govt schools not having principal: AAP leaders, including CM Arvind Kejriwal, had targeted Gujarat schools in view of upcoming state assembly elections

- Unveiling the NEET UG 2024 scandal, CBI targets the notorious Sanjeev Mukhiya gang with CBSE city coordinator Ehsanul Haq and chairman Shabir Ahmed under scrutiny, exposing corruption across Bihar & Jharkhand, involving tampered exam papers and fraud

- “Hell is empty and all the devils are here”: Four employees of a Hamilton daycare fired after a video of them scaring children at the facility went viral on Facebook, children can be seen and heard crying and running away from employee wearing the mask

- Shocking scandal unfolds in Karnataka, Headmistress Pushpalatha forced 10th class minor boy to kiss, hold her in arms and tug her saree for a photoshoot during an educational school trip, pics leaked & went viral, igniting widespread outrage among parents

- "I had a calling to become what I became - I was created to do this": Srinivasa Ramanujan, mathematical genius who knew infinity credited his all formulae to visions of Mahalakshmi, "An equation for me has no meaning, unless it expresses a thought of God"

- Madras High Court: Do not take decision on melting Temple gold till Trustees are appointed

- "Historians in India gave prominence to Mughals only, ignored glorious rules of many empires": Union Home Minister Amit Shah asks historians to revive the glory of the past for the present, concentrate on Pandyas, Mauryas, and Cholas

- ‘Inappropriate question’ on Gujarat riots asked in class 12 sociology exam: CBSE promises strict action

- "Education is learning what you didn't even know you didn't know": The Rising Phoenix: A Comparative Study of the College Shutdowns in America, the Ascendancy of Indian Education and undergoing significant change in Landscape of higher education globally

- Why Hindu-Sikh genocide of Mirpur in 1947 ignored? Why inhuman crimes of Radical Islamists always hidden in India?

- "उसकी गलती क्या थी": In a devastating turn, 12-year-old Kintan Saraswat's aspirations to become an IAF officer were crushed under the weight of brutal bullying and grave medical neglect, propelling his shattered family into a relentless quest for justice

- "इस्लामी तालीम": Vikram Univ initiates a thorough investigation into Prof Anis Shaikh for promoting Islam, systematically giving lower grades to Hindu students and forming an exclusive WhatsApp group for female students, stirring significant campus unrest

- Burning issue prompted thousands of IIIT Basara students to take streets in protest against incumbent TRS government, but Agnipath noise drowns their voice: No widespread coverage since the mainstream media has deliberately neglected it

- Goa Inquisition and massacre of Native Hindus by Portuguese: A Forgotten Chapter of the Bloody History of the European Colonization of India